Crude oil is retracing and a Nymex Light test of $60/barrel would take some of the heat out of the commodities market. A rising rig count in the US may help to increase supply and ease oil prices.

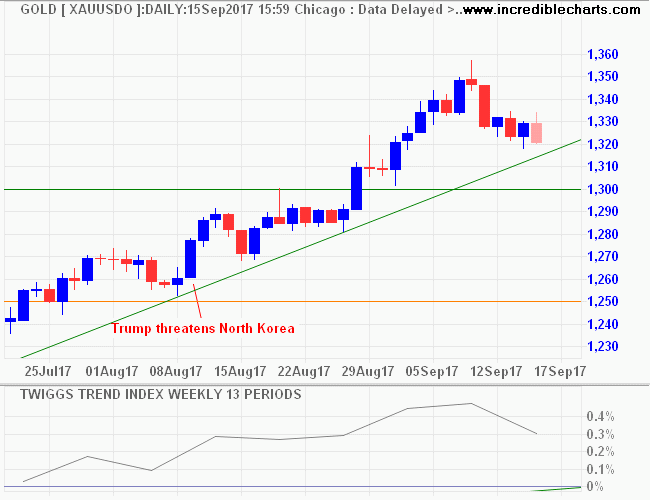

Political tensions remain high, with the Turks bombing Kurd-controlled territory in Syria, Iran proxies in Yemen firing missiles at Saudi Arabia, North Korea showing no signs of caving to sanctions pressure over its nuclear weapons program, and Russia fomenting tensions in the Balkans between Serbia and Kosovo.

Stock markets shrugged off the usual conga-line of autocrats behaving badly, instead focusing on signs of a reviving global economy. South Korea’s Seoul Composite Index is headed for a test of resistance at its November high of 2560. Respect of the rising trendline is bullish but the latest Trend Index rally is weak and a bearish divergence may be forming.

Japan’s Nikkei 225 Index remains bullish. A Trend Index trough high above zero indicates strong buying pressure.

China’s Shanghai Composite Index broke resistance at its November high of 3450 to signal another primary advance.

India’s NSE Nifty Index is advancing toward its target of 11000*. Trend Index troughs above zero signal long-term buying pressure.

Target 10500 + ( 10500 – 10000 ) = 11000

In Europe, the DJ Euro Stoxx 600 broke resistance at 396. Trend Index recovery above the declining trendline indicates buyers are back in control.

The Footsie met short-term resistance at 7800 and is likely to retrace to test its new support level at 7600. Trend Index recovery above the declining trendline again indicates buyers have taken control.

Moving to the US, the Dow chart says it all. Investors continue to shrug off concerns about high valuations as the up-trend accelerates. The few corrections over the last 12 months have been both mild and of short duration. A rising Trend Index, with troughs high above zero, indicates strong buying pressure. It is important to remain objective, focus on the long-term, and not to get caught up in the euphoria. Heady gains like this inevitably lead to a sharp blow-off. The question is: when?

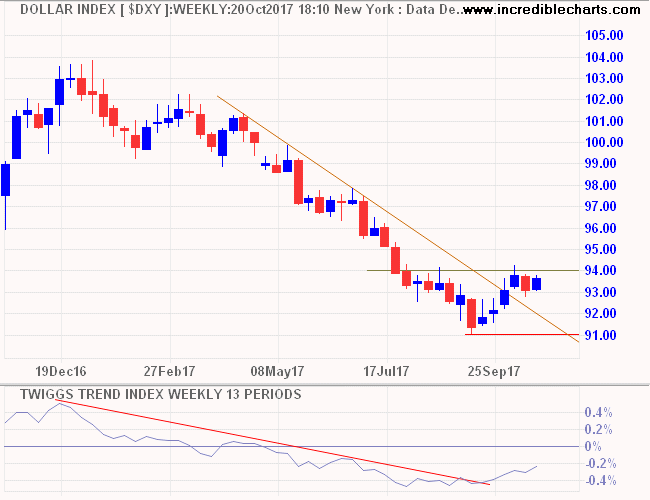

Right now it seems the rocket has plenty of fuel, with tax cuts expected to stimulate both buybacks and new capital investment, while a falling US Dollar should boost US manufacturer’s competitiveness both at home and abroad. A sharp reversal could be many months away.

It’s time that the Fed took the punch bowl away, to calm things down before the party really gets out of hand.